In the world of online personal finance services, each site performs the standard tracking and reporting features respectably, but it’s the execution and additional features that make a service standout. For Yodlee, which powers Mint.com and 32 of the top 50 banks, its strengths are the number of accounts you can add, net worth calculation, and plethora of alert options.When it comes to adding accounts and assets to Yodlee, it goes far beyond tracking your checking account and emergency fund. Investments, retirement accounts, real estate, rewards accounts, cell phone accounts, student loans and many others can be linked to your Yodlee account to create a truly centralized place for your finances. The ability to bring all of your student loans into one location is welcome news to anyone who owes more than one lender for their college education. As disheartening as it can be to see just how much you owe, knowing how much you debt you have is an important part of making financial decisions.When linking up real estate accounts you can choose to manually enter a value to be used for net worth tracking or rely on Zillow.com’s Zestimate to get automatically updated values that are calculated in your net worth.The ability to link in all of your accounts is what leads to Yodlee’s next strength; an easy-to-use net worth calculator. After adding all of your accounts, it only takes a second to get an accurate view of your net worth. you can use this statement to track the general trend of your net worth and get a general view of your assets and liabilities.

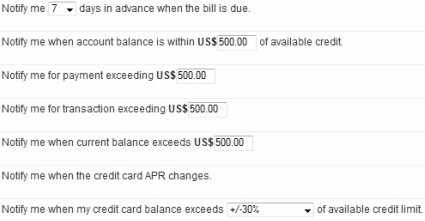

In the world of online personal finance services, each site performs the standard tracking and reporting features respectably, but it’s the execution and additional features that make a service standout. For Yodlee, which powers Mint.com and 32 of the top 50 banks, its strengths are the number of accounts you can add, net worth calculation, and plethora of alert options.When it comes to adding accounts and assets to Yodlee, it goes far beyond tracking your checking account and emergency fund. Investments, retirement accounts, real estate, rewards accounts, cell phone accounts, student loans and many others can be linked to your Yodlee account to create a truly centralized place for your finances. The ability to bring all of your student loans into one location is welcome news to anyone who owes more than one lender for their college education. As disheartening as it can be to see just how much you owe, knowing how much you debt you have is an important part of making financial decisions.When linking up real estate accounts you can choose to manually enter a value to be used for net worth tracking or rely on Zillow.com’s Zestimate to get automatically updated values that are calculated in your net worth.The ability to link in all of your accounts is what leads to Yodlee’s next strength; an easy-to-use net worth calculator. After adding all of your accounts, it only takes a second to get an accurate view of your net worth. you can use this statement to track the general trend of your net worth and get a general view of your assets and liabilities. Another place that Yodlee shines is the abundance of reminders that are available to users once they’ve provided their email and phone number. The number and depth of alerts that you can set from within Yodlee is amazing. On top of the basic alerts that all tools offer, you can configure Yodlee to tell you about changes in your net worth, an increase in your credit card interest rate, if you’re getting close to your cell phone minute usage and much more. I really like that Yodlee lets me set up these alerts so that I don’t have to waste my time thinking about my finances when I’m taking a break.The only downside I experienced during my use of Yodlee was its inability to link up with my credit union for automatic updates. I can still add the information manually, but until my credit union’s online portal leaves the 1990′s or Yodlee adds support, I’ll stick to Quicken for my day-to-day operations and focus on Yodlee for student loan aggregation, net worth statements and reminders.The Yodlee service is available from many banks and through Mint.com. You can also sign up at Yodlee.com where it rolls out new features first. If you are lucky enough to have Yodlee at your financial institution, you also have access to a useful bill pay service and money transfer module that integrates nicely with all of your accounts. Even though it’s mainly a behind -the-scenes player, Yodlee is a worthwhile financial tool that makes tracking all of your financial information easy.

Another place that Yodlee shines is the abundance of reminders that are available to users once they’ve provided their email and phone number. The number and depth of alerts that you can set from within Yodlee is amazing. On top of the basic alerts that all tools offer, you can configure Yodlee to tell you about changes in your net worth, an increase in your credit card interest rate, if you’re getting close to your cell phone minute usage and much more. I really like that Yodlee lets me set up these alerts so that I don’t have to waste my time thinking about my finances when I’m taking a break.The only downside I experienced during my use of Yodlee was its inability to link up with my credit union for automatic updates. I can still add the information manually, but until my credit union’s online portal leaves the 1990′s or Yodlee adds support, I’ll stick to Quicken for my day-to-day operations and focus on Yodlee for student loan aggregation, net worth statements and reminders.The Yodlee service is available from many banks and through Mint.com. You can also sign up at Yodlee.com where it rolls out new features first. If you are lucky enough to have Yodlee at your financial institution, you also have access to a useful bill pay service and money transfer module that integrates nicely with all of your accounts. Even though it’s mainly a behind -the-scenes player, Yodlee is a worthwhile financial tool that makes tracking all of your financial information easy.

-

Recent Posts

- If you must get a stuget a loandent loan, find a fixed rate

- Graduates Keep Struggling With Private Sthome loan calculaterudent Loans

- Averagsba loan requirementse Student Debt Hits Record High in 2010: $25,250

- Trick or Treat, the Personal Finance Ediblackhorse loanstion: Sweet Deals and Scary Mistakes

- Csbi home loanitigroup May Sell Student Loan Corp. to Sallie Mae Consortium

Recent Comments

Archives

Blogroll

Meta